On December 20, 2017, the United States Congress passed a tax bill which changed many provisions of the United States tax code. Many of those most prominent changes received extensive coverage by the press. One smaller provision, however, did not receive much attention, but has the potential to affect sexual harassment cases in a significant way. Today’s Long Island employment law blog discusses the so-called “Weinstein” provision in the new tax bill.

Sexual Harassment Cases

For many reasons, victims of sexual harassment are often reluctant to bring their stories to light and to seek justice for the abuse they faced. One of the reasons victims are reluctant is that sexual harassment cases are often he said, she said, so victims are afraid that they won’t be believed. Perhaps a more troubling reason is that victims are worried that by making their claims public, their careers and/or reputations will be hurt.

At Famighetti & Weinick, PLLC, we often hear these concerns when we’re counseling our clients about their options for seeking redress as a victim of sexual harassment. One of the options we offer is by seeking a resolution in a private and confidential manner, such as mediation. Through a private resolution means, like mediation, the parties are comfortable knowing that they can craft a resolution which achieves their objectives, and that the result and the process of reaching that resolution, will remain private and confidential. This often a relief for sexual harassment victims who are concerned about publicly fighting their case.

The “Weinstein” Provision in the New Tax Code

The Harvey Weinstein scandal coming out of Hollywood has shed light on the epidemic of sexual harassment in the workplace. The bravery of the women coming forward has inspired many other victims to come forward, including victims of sexual harassment in Washington D.C. With these stories coming to light, attention has also be drawn to the fact that many victims reached private settlements with the accused. These agreements often entail a payment of money to the victim, in exchange for an agreement that the allegations and the payment will remain confidential. Additionally, because these payments are often made by corporations, the payments were often considered business expenses, meaning corporations would not pay taxes on these payments. The tax code also allowed victims to deduct attorneys’ fees from taxable income.

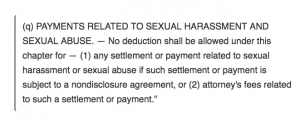

According to the New York Times, Senator Robert Menendez said “I think most Americans would be outraged to know they that are subsidizing sexual predators in the tax code.” So, the new tax code contains a provision which has come to be known as the “Weinstein Provision.” The provision reads:

“No deduction shall be allowed under this chapter for — (1) any settlement or payment related to sexual harassment or sexual abuse if such settlement or payment is subject to a nondisclosure agreement, or (2) attorney’s fees related to such a settlement or payment.”

In other words, payments made to sexual harassment victims are not tax deductible if the agreement to pay is included as part of a confidentiality agreement. But, attorneys’ fees’ are also not deductible.

Tax Consequences for Sexual Harassment Victims

The “Weinstein” Provision is likely to have little effect on huge corporations. The benefit of confidentiality outweighs any potential negative tax implications, particularly in light of the other cuts set forth by the new tax code. The new provision, however, may have serious implications for smaller businesses and sexual harassment victims. For smaller businesses seeking confidentiality, the tax implications may not justify including a confidentiality provision. Oftentimes, sexual harassment defendants will settle a claim solely to obtain confidentiality. Because many sexual harassment cases are he said she said, defendants feel confident about putting their credibility up against the victim’s. So, defendants may choose to take more sexual harassment cases to trial. With the uncertainty of trials, many more victims of sexual harassment stand to go uncompensated for the abuse they faced.

Additionally, the new provision can be read so as to penalize victims. Previously, attorneys fees for sexual harassment victims were not taxable. The new provision does not distinguish between the victim’s attorney’s fees and the accussed’s attorneys’ fees. The victim usually pays her attorney a portion of any settlement amount. Now, the tax code can be interpreted as requiring the victim to pay taxes on the total settlement, even though she did not receive the entire amount, because a portion was paid to her attorneys. Thus, the tax code seems to punish victims who must choose to between taking a payment and maintaining confidentiality, or turning down confidentiality and taking her chances in a courtroom. Moreover, it is sometimes the victim who also wants confidentiality, so the premise that only a defendant is pushing for it, is false.

Long Island Sexual Harassment Lawyers

Famighetti & Weinick, PLLC are Long Island sexual harassment lawyers. Today’s blog was for informational purposes only and should not be used as tax or legal advice. If you have further questions about sexual harassment or the implications of the new tax code on sexual harassment settlements, contact a Long Island employment at 631-352-0050 or on the internet at https://www.linycemploymentlaw.com.

Long Island Employment Law Blog

Long Island Employment Law Blog